Finance Management

10 Tips for Effective Financial Management

The below tips will help you be successful in managing your company's resources!

1 – Generate Money

Whether to start or maintain your business, you need money. And it is obvious that, to take the first step and launch your business, a capital investment is necessary.

Furthermore, as the company grows by increasing its portfolio, hiring professionals or investing in marketing and sales , each stage requires financial management.

2 – Make Good Financial Planning

To practice sound financial management , you must obtain and allocate resources to operations and establish supportive policies for these activities.

Having financial planning in conjunction with revenue predictability helps in this regard. And don't forget that your team needs to be more than capable of meeting all the requirements that lie ahead.

3 – Organize the Operation

Companies move huge amounts of money every day. These amounts must later be used to pay bills, delegate funds and invest in various commitments, among others.

Along with financial planning, it is important to monitor operations and manage the inflow and outflow of money. Otherwise, it becomes difficult to allocate funds efficiently and effectively. Not to mention that the irregular flow of values can ruin a company.

4 – Manage Cash Flow

Having excessive funds is as fatal as having too little. For an organization to continue with its daily processing, it is essential to manage cash flow .

In case you have higher funds and are not using them as required, it means wastage of resources.

For a company with surplus cash, putting it to use and investing in significant commitments brings better returns and helps grow the business.

5 – Carry out a Spending Strategy

Of course, you want to allocate funds and use them to map out regularly occurring expenses.

However, spending any or all money without proper planning is not wise. You need to track expenses, monitor frequency, and then decide how to spend and how much to spend.

Sometimes it is important to cut extra costs and reduce expenses. And this can only be done when you have effective financial management .

6 – Set Long-Term Goals

Organizations work to grow and expand their businesses. To do this, it is important to have significant future goals that your industry or distributor aims to achieve within a period of five or ten years.

Financial management enables you to attain your objectives without failing. Consider that you intend to grow your company to three additional cities. You run out of money as long as you follow through on the strategy.

This wouldn't have happened if you had managed your organization's finances and then executed.

Prior planning and working with the organization's available cash help eliminate future possibilities of crisis and, at the same time, move towards achieving your objective.

7 – Prepare for Adversity

If you look at an organization's growth chart, you will never find one that grows in a straight line or without curves.

Growth is a mix of ups and downs that can obviously be caused by a variety of reasons. The main ones involve recession, economic boom or bankruptcy, everything adds to a company's performance.

This way, with sufficient finances and adequate financial management , it becomes easier to go through the business cycle. Fail-safe financial management plans help the organization thrive despite adverse economic conditions.

8 – Use Technology to Your Advantage

Technology is able to help connect all financial management processes and procedures , which leads to a series of long-term benefits, such as achieving operational and financial goals.

They are even capable of automating processes, generating financial statements and monitoring decisions that affect profits, as well as monitoring the results of their financial decisions.

9 – Define Performance Indicators

As you know, performance analysis is a fundamental point for the company's good financial health. And the best way to do this control is to monitor performance indicators periodically.

The choice of indicators must be made during the planning phase, considering the company's objectives. What metrics are part of your strategy?

These are some indicators widely used in financial management :

- profitability;

- profitability;

- invoicing;

- gross margin;

- net margin;

- balance point.

10 – Control Costs

Finally, controlling your business costs is essential for it to prosper. This is because this management is part of the monitoring and analysis processes of all the company's fixed and changeable costs.

This is how you will be able to cut unnecessary expenses, as you will be able to identify where the money goes. Furthermore, control also allows you to have more control over cash flow, without reducing productivity.

That's why it's so important to keep an eye on all the company's costs, periodically. If you need help, it's ideal to look for a tool that makes managing these values easier.

Author: admin

Date: Sep 17 2023

What is Financial Management for?

The main objective of financial management is to keep a company's expenses balanced in relation to its revenue. The objective is for it to operate positively, that is, profitably.

This control is essential for companies to have good financial health and remain operational. Without efficient control, the company will probably not be able to remain open for long.

What Processes Are Involved in Financial Management?

As one of the main sectors of any company, finance ensures the management and division of available cash resources. But this distribution needs to occur in a planned and strategic way.

This is because, as you know, these resources are essential for the company to continue functioning normally. Therefore, it is fair to say that the financial sector is essential for any and all businesses to continue existing.

But what are the processes involved in financial management ? There are many of them, all different. A company can have several, depending on the market in which it operates, whether it is an industry or a distributor , among others.

One of the main processes is the management of accounts payable and receivable. It allows you to control the inflow and outflow of money. Without good detailing of this information, the company will have difficulty operating.

In addition, you also need to keep an eye on cash flow control . The idea is to understand how the company's balance is going, which makes it easier to create a plan for good use of working capital .

All financial management is aided by fundraising , another very important process for any business. This is because, without it, the company will not be able to raise the necessary amounts to be able to operate, especially at the beginning.

Finally, one of the most frequent processes is billing . It is through this that the issuance of invoices becomes possible. It also facilitates control of entries and exits, as well as contact with logistics.

Of course, each company will have specific processes, according to the activities it carries out. But it is still important to have a basis of which are the most common, facilitating budget management and improving financial health .

How Important is Financial Management for Companies?

There is no doubt that finances are one of the most important aspects of a business. And, in fact, financial management is fundamental when making decisions, providing paths to achieve goals and objectives.

For example: if your industry or distributor has larger funds, a portion can be used for investment purposes. Likewise, if the organization has funds less than the threshold amount, it is important to stop unnecessary spending.

To be more specific, it is not enough to understand what financial management is , you need to understand its importance for an organization.

Know that it helps the company to know where financial resources are used. This overview will help determine whether it will be possible to make any investment: what to spend, where and when to spend it, among other actions.

Financial management gives a better view of the organization's situation when it comes to money. This is because it acts as a kind of x-ray of all the processes and operations carried out.

11 objectives of financial management

Financial management aims to guide definitions involving financial resources such as investments and use of capital, for example.

It ensures that all bills are paid on time, as well as being essential in planning, organizing, directing and controlling the bank balance .

Discover 11 other purposes of financial management below :

- Provides guidance on financial planning;

- Assists in obtaining funds from different sources;

- Helps you invest intelligently;

- Increases organizational efficiency;

- Reduces production delays;

- Reduces financial costs;

- Supports making the best financial decisions;

- Prepare guidelines to obtain maximum profit with minimum cost;

- Controls all financial aspects of the business;

- Provides information through financial reports;

- Encourages employees to save inputs and products.

What are the 4 Pillars of Financial Management?

The process of organizing corporate financial management has 4 pillars. Find out more about each of them!

To plan

Planning is the first pillar of financial management and serves to define the results to be achieved. Therefore, he must consider a series of factors, such as identifying investment opportunities and cost reduction.

In the planning phase, company management must both define goals for a given period and draw up plans for crisis control. So, having an emergency plan can define the fate of the business in these scenarios!

To control

Financial management control should not be confused with cash flow control, that is, the recording of what enters and leaves the company's account.

The latter is a process that is part of the strategy, but here we are talking specifically about controlling the execution of processes.

A good financial manager must ensure that all planned processes are running and, if not, understand what is hindering the flow. This way, it is possible to develop corrective actions and avoid future errors.

To analyze

For good decision making, it is essential to always analyze the data and results. Therefore, the best thing to do is find points for improvement, reduce costs and understand what type of action brings the most favorable results.

Invest

It is important that all investments made by the company are decided based on the previous pillar. This indicates that you must carry out a thorough analysis of the data available about the business.

This is how it is possible to choose investments that bring results that contribute to the company's financial health. They also usually have a level of risk that the organization is willing to deal with.

In financial management , any investment must be seen as a strategic decision. In addition, also consider purely financial data, information about hiring, growth, acquisitions, purchases, inventory, among others.

Author: admin

Date: Sep 17 2023

What Is a Budget, Types and How to Create Yours

A well-structured budget has the power to positively affect any business, or even the financial situation of a home. In the same way that if it is neglected it can have a harmful impact.

Whether you are an entrepreneur, manager or responsible for a company's finances, the budget is a fundamental tool for success and sustainable growth. However, many still underestimate its importance or don't know where to start.

Another way is to continue reading this article. Next, we'll uncover the secrets behind the budget and show you how you can use it strategically.

What Is a Budget?

A budget can be defined as a plan that helps estimate expenses, income and possible investment opportunities over a specific period.

In other words, it is an essential way to set goals and closely monitor the results achieved.

By plotting it, it is possible to easily identify if something is out of plan and, thus, take corrective measures or make necessary adjustments. Furthermore, it makes it possible to act preventively, anticipating possible problems or unforeseen events.

How Important Is a Budget?

It is essential to understand the importance of organizing a budget, as this allows you to have greater control and care with your money, paying attention to details.

Can you say, for example, how much you earn after paying all taxes and other bureaucracy? And how much and how do you spend monthly?

This basic information is crucial for creating and maintaining a financial plan , but many companies neglect it.

Through this instrument, it is possible to act in accordance with our objectives, regardless of what they are.

As long as they involve the use of financial resources to be achieved, a well-structured budget provides us with the necessary basis to make informed decisions.

What Are the Benefits of Budgeting?

Budgeting ensures that you don't spend more than you earn . However, this is not the only advantage of organizing your finances with this tool.

Objectivity of Spending

A budget allows you to set clear spending goals in different areas. This helps to avoid waste and unnecessary expenses, directing resources more efficiently and objectively.

Spending Control

Good planning allows for close monitoring of everything spent to find out if anything is out of line with expectations. This way, there will be no deviations and, if there are, corrective measures will be applied quickly.

Making Investments More Safely

With pre-established values, the company can allocate specific resources to certain investments.

Thus, a more careful analysis of the risks and opportunities involved can be carried out to invest with greater security and basis, increasing the chances of success and financial return.

Communication and Alignment

The budget serves as a communication and alignment tool between the different departments and hierarchical levels of the company.

It provides a common understanding of financial goals and promotes collaboration to achieve them. So, with it, everyone in the organization has clarity about available resources and financial constraints.

What Are the Types of Budget?

There is not just a business-oriented budget . So check out all the types!

Business budget

The business budget is known for being one of the most complex types. This is because, normally designed for a period of one year, it can be divided into months to allow for more detailed monitoring.

To develop it, it is necessary to consider not only historical data, but also to carry out an analysis of the company's current situation, its objectives and market perspectives.

Its preparation prepares the business to make the most of the challenges and opportunities that arise. Furthermore, it also makes it easier to predict resource allocation and correct errors.

This way, available resources can be used in an efficient and targeted way, maximizing results and minimizing risks. In other words, it does not compromise the future.

Personal Budget

The personal budget has as its central objective you and your relationship with money. This is planning that considers your income and expenses, always keeping the defined objectives in mind.

The advantage of a personal budget is that you have total control over meeting established estimates and deadlines, which provides a greater level of commitment.

However, it is necessary to be aware and self-regulate: if the plan is not carried out seriously, your objectives become further away.

By adopting a personal budget , you have a clear view of your finances, allowing you to identify areas of excessive or unnecessary spending. This way, you can redirect your money to investments, savings or other priority needs.

Home Budget

The household budget is directed towards expenses related to the house and everything necessary for the proper functioning of the home. This includes food, which consumes a large part of resources.

However, there are other items, such as water, electricity, internet, telephone bills, as well as maintenance and home improvement expenses. Everything needs to be economically efficient.

One of the main difficulties faced when dealing with this type is involving all family members in this cause, especially when there are several people together. It is important that everyone is committed and engaged to be successful.

Public budget

The public budget is an essential process for planning and managing government finances. It is an instrument that establishes the revenues and expenses of the public sector in a given period, generally a fiscal year.

The main objective is to adequately allocate available resources, in order to meet the needs of society and promote economic and social development.

Through this process, governments define their investment priorities and direct resources to areas such as health, education, infrastructure, security, among others.

If well designed and executed, it contributes to economic stability, sustainable growth and improved quality of life for the population.

Participatory budgeting

This is a financial management approach with the active participation of citizens in defining priorities and allocating public resources.

In this model, people have the opportunity to directly contribute to decision-making about how the budget will be used in their community or region.

One of the main characteristics of participatory budgeting is social inclusion. This is because it allows the active voice of diverse groups to express their needs, propose projects and directly influence the policies and programs that affect their lives.

Family budget

It covers not only the organization of the family's daily expenses, but also the long-term goals that involve all members. It could include college, a trip or weekly outings for entertainment.

Financial control can be a greater challenge, as sources of income and expenses multiply with the different needs and preferences of each family member.

However, the secret to a successful family budget lies in maintaining discipline and commitment from everyone involved.

An effective strategy is to use a shared spreadsheet, in which everyone can record and update their income and expenses in real time.

How to Make a Budget?

When it comes to establishing an efficient budget , there are several fundamental steps and principles that can be applied. While approaches may vary, the following tips are helpful for whichever method you choose.

Establish Goals and Objectives

Start with setting clear goals and objectives. Ask yourself what you want to achieve financially and set priorities to guide your spending.

Understand Billing-Related Costs

This point is crucial for the next steps of financial planning. At this stage, it is necessary to calculate the costs directly linked to the company's growth . It is essential to have access to all financial information to carry out accurate calculations.

Detail Expenses

Now is the time to estimate all expenses not directly related to revenue. At this stage, it is important to consider all areas of the company, including operational , personnel, administrative and marketing expenses .

It is essential to plan for the year, considering possible changes in each of these areas, such as hiring new employees.

Project Cash Flow

The penultimate stage of planning consists of projecting the cash flow for the given period. In addition to this projection, it is important to analyze the company's current financial situation.

Follow the Results

It is essential to carry out detailed monitoring of financial planning. Here it is possible to identify quick improvements for the business, which contributes to the company's results.

Tips for Taking Care of Your Company’s Budget

To create an effective budget , it is important to follow some essential assumptions. This way, you will be better prepared to make solid financial decisions and achieve your business objectives in a sustainable way. Are they:

- know your business's financial cycle to consider cash vulnerability in certain periods;

- estimate the growth of the enterprise, which may affect price increases, diversification of the product mix or gain in market share;

- use the Income Statement (DRE) to understand the cash aspect;

- manage your cash balance, as if this is the case, it is important to draw up a plan to boost the business and guarantee the availability of resources;

- carefully analyze expenses and question their need, as well as identify opportunities for optimization or negotiation of fixed amounts.

Author: admin

Date: Sep 17 2023

What are expenses, types and how to control them efficiently

Expenses are part of the routine of any company . These payments are essential for maintaining the business. After all, without them, the company would not be able to hire people, buy raw materials or take care of its administration.

However, you have to be very careful. This is because paying expenses means taking money out of the cash register. This can be very dangerous for the financial health of the business if it is not done with planning and awareness of the current situation.

In this article, you will understand what expenses are , what the difference is between expenses and costs and check out our tips for controlling them.

Now, let's move on to the text. Follow below!

What Are Expenses?

Expenses are resources applied to the management structure of a company, with the aim of supporting its operation as a whole . In short, we can say that they are related to business administration.

This is because these resources are applied to the commercial, marketing , product development and financial areas. In other words, they are not directly related to production – these are costs, which we will talk about later.

What Are The Types Of Expense?

Expenses are classified into five types and knowing them is essential so that you know how to classify them and, therefore, manage them better .

Fixed expenses

Fixed expenses correspond to fixed monthly expenses, as the name suggests. They are constant and, in many cases, predictable, as they are not linked to fluctuations in production volume.

Variable Expenses

The variables are those that are related to the volume of production and, therefore, the values fluctuate from one period to another.

Examples of variable expenses are commissions paid to employees, taxes calculated based on the company's revenue , expenses with transport and distribution of products, bonuses offered to employees, among others.

Operational expenses

Operating costs are those expenses that are essential to keep the company running. They can be administrative, commercial or specific:

- Administrative: relate to salaries and benefits, taxes and insurance;

- Commercial: those aimed at publicizing the business, such as press relations, advertising and gifts;

- Specific: they are unique to each company and vary according to the internal policies of each organization.

Non-Operating Expenses

The non-operational ones are those that are not directly linked to the functioning or carrying out of the main activity of the company. Some examples are the payment of interest and dividends.

Pre-Operating Expenses

Pre-operational activities are essential for the company to be able to carry out its activities and expand its processes. They are paid before production begins and are inevitable for the implementation of the business.

How Important Is It to Classify Expenses Correctly?

Classifying expenses correctly is the first step for the manager to gain an in-depth understanding of the company's financial profile. This way, it is possible to manage them more effectively, understanding where each part of the resources disbursed goes.

This makes it easier to control expenses and measure the financial health of the business, which allows for more conscious decision-making. With this knowledge, it is possible, for example, to understand whether it is time to cut expenses or invest in business expansion.

But if the decision is to cut expenses, knowing the expenses is essential to know which ones can be cut so that the business is not harmed.

What is the difference between costs, expenses and expenses?

The terms “costs”, “expenses” and “ expenses” are used in the financial context of companies, and each one has a specific meaning.

Costs refer to the expenses associated with the production of goods or services in a company. They include raw materials, direct labor, energy, rental of facilities and other resources necessary to manufacture the products.

Expenses, on the other hand, are the expenses incurred to acquire assets or investments that will benefit the company in the long run. Examples of expenses include the purchase of equipment, machinery, vehicles and real estate for the company.

Expenses are those expenses necessary for the daily operation of the company, but which are not directly related to production. This may include administrative salaries, office rent, utility bills, marketing expenses and corporate travel.

Cost Examples

Costs, as we said, are linked to the production of a company, that is, to the financing of the materials and processes necessary for the execution of its core activity.

These are some examples of costs:

- purchase of raw materials;

- hiring of labor;

- purchase of packaging;

- electricity;

- Machine maintenance;

- depreciation of machinery and equipment;

- cleaning and conservation materials for the factory plant.

Examples of Expenses

Expenses are related to all other activities carried out by the company , with the exception of its core activity, which is production. As examples of expenses we can mention:

- renting the space where the company operates;

- hiring employees who work in other sectors, such as human resources and finance;

- sales costs ;

- office supplies ;

- consumption bills , such as internet, for example;

- expenses on benefits offered to employees, such as snacks, for example.

Spending Examples

Example of business expenses: Purchase of new machinery, investment in cutting-edge technology, acquisition of stock, payment for consultancy services, hiring an advertising agency.

What influence do costs and expenses have on the budget?

Knowing the company's costs and expenses well is very important for adequate budget planning.

All these expenses need to be predicted so that the correct division of values can be made for each sector. Furthermore, it includes the definition of priorities, if it is not possible to cover all needs.

All this work is only possible when the manager knows all the costs and expenses of the business, in addition to the amount needed for each sector.

Some companies do not correctly classify their expenses or divide their resources. Therefore, they run the risk of not having enough cash to properly operate each sector.

Therefore, it will be necessary to rearrange values after the problem is already established, or, worse, need to deal with the lack of resources for proper operation.

Tips for Optimal Control of Expenses

Now that you know what expenses are and how important it is to know and classify them, check out some tips for better control in your company!

Have a Financial Plan

Planning is the first step towards more efficient management . It must aggregate all information about the company's finances and serve as a guide for managers, indicating objectives, goals and actions necessary to achieve them.

Build a Control Flow

This flow doesn't need to be very complex to work. The important thing is to designate a person to carry out the control and define a frequency to analyze the results.

Define Indicators

For the analysis to be successful, it is important to define which indicators will be monitored.

And don't forget to document the results for each analysis. This way it is possible to understand which sectors are bringing the best results and which ones need improvements.

Control Stock

Poorly managed inventory can cause financial losses – after all, idle product is idle money. Therefore, invest in training the team responsible for this management!

Don't Miss Payment Deadlines

Late payments are, without a doubt, one of the main sources of unnecessary expenses. Be sure to pay attention to these deadlines and, if you are unable to pay, negotiate with your suppliers to avoid fines.

Count on Technology

Having management software will help you automate many of these control activities. Furthermore, it will reduce the chances of errors and provide ready-made reports on the company's expenses . This makes the entire analysis process more efficient!

How to Identify Possible Unnecessary Expenses?

One of the best practices for efficiently managing business expenses is knowing when to cut expenses — and which ones can be cut.

The first step to this is to make a list of all the company's expenses , no matter how small they may be. Only in this way is it possible to have an overview of all of them and, from there, start prioritizing.

The next step, therefore, is to classify these expenses as essential, important or superfluous.

Initially, you must cut superfluous expenses , which are those that, in the end, do not directly impact the financial result of the business.

In more serious situations, it may be necessary to cut other expenses , which may have more impact on results.

Prioritize the most important expenses and cut those that you think have the least influence on sales results at the end of the month.

How to Analyze a Company’s Costs and Expenses?

Analyzing a company's costs and expenses is essential to understanding its financial health. Here are some steps to perform this analysis:

- Collect data: Gather detailed information about the company's costs and expenses , including accounting records, receipts, invoices and financial reports.

- Classify costs and expenses : Organize expenses into relevant categories such as raw materials, labor, rent, marketing, energy, and more. This will make it easier to understand and analyze the numbers.

- Calculate percentages: Determine the percentage of each category in relation to total costs and expenses . This will help identify areas that consume the most financial resources.

- Compare to previous periods: Analyze current costs and expenses compared to previous periods, such as previous quarters or years. This will reveal significant trends and variations.

- Benchmarking: Compare the company's costs and expenses with similar companies in the same sector. This will allow you to assess whether spending is within acceptable standards and identify possible areas for improvement.

- Identify variations: Analyze which costs and expenses are above or below expectations and investigate the reasons behind these variations. This may involve identifying inefficiencies, cutting waste or adjusting strategies.

- Assess profitability: Consider how costs and expenses affect the company's profitability. Identify the products, services or areas of business that generate the most profit and those that are struggling financially.

- Take corrective measures: Based on the analysis performed, take measures to reduce costs, optimize expenses and improve operational efficiency. This may include renegotiating contracts, seeking more competitive suppliers or implementing expense control programs.

Regularly analyzing costs and expenses will allow the company to make more informed financial decisions, identify savings opportunities and maintain solid financial health.

Author: admin

Date: Sep 17 2023

What Are Financial Statements, How To Do Them And Importance

Financial statements are accounting reports of a company. They are necessary for several reasons – to fulfill obligations required by the Federal Revenue Service, to assist in decision-making and to give the manager a broad view of the financial life of the business.

To better understand what financial statements are and their importance, we have prepared this content. It also contains a list of the main documents that need to be issued by companies. Follow along!

What Are Financial Statements?

Financial statements are accounting reports issued by a company. They aim to detail your financial situation.

From there, it is possible to control a series of information about the finances of the business, understanding whether it operates in the red or is profitable , among other things.

Some financial statements are mandatory and have their issuance frequency defined by the Federal Revenue Service – normally those related to taxes. Some examples are the Balance Sheet , the Income Statement and the Cash Flow Statement.

But, in addition to complying with the obligation, the company can prepare these statements more frequently than required by law. The goal is to carry out a thorough analysis of finances or even render accounts internally to partners, shareholders and managers.

What Is The Purpose Of Financial Statements?

Financial statements , as we said, serve several purposes:

- report to the Federal Revenue;

- assist the government in collecting taxes;

- prevent fraud and tax evasion crimes;

- give the manager an overview of the company's financial health;

- help with decision making ;

- allow the manager to have more control over cash flow;

- make it easier to obtain insights that can be very valuable for business.

How Important Are Financial Statements for Companies?

It is through the analysis of financial statements that a company's managers can make smarter decisions about the future of the business.

And this applies to all areas, not just finance. After all, the entire company must function with the aim of generating profit .

Financial statements are also important for companies seeking credit, as they serve as proof of income and payment capacity.

As we have already said, they are also used as a way of reporting to shareholders, investors and partners. This is because not everyone is always present in the day-to-day running of the business. This makes it easier for you to see the company's financial health.

Just by constantly recording information and gathering data to prepare financial statements makes control over the company's accounts much greater. Managers’ knowledge of how the business operates also has an impact.

What Are the Main Types of Financial Statements?

Now, we have already shown what financial statements are and their importance for the company. So, let's present its main types and talk a little about each of them!

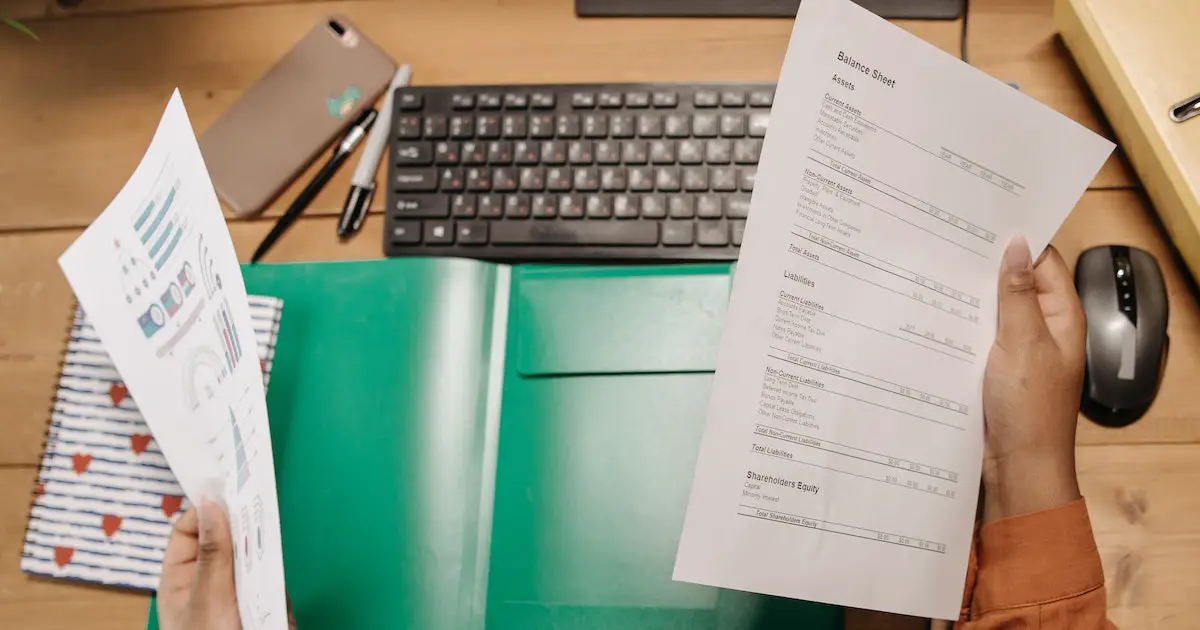

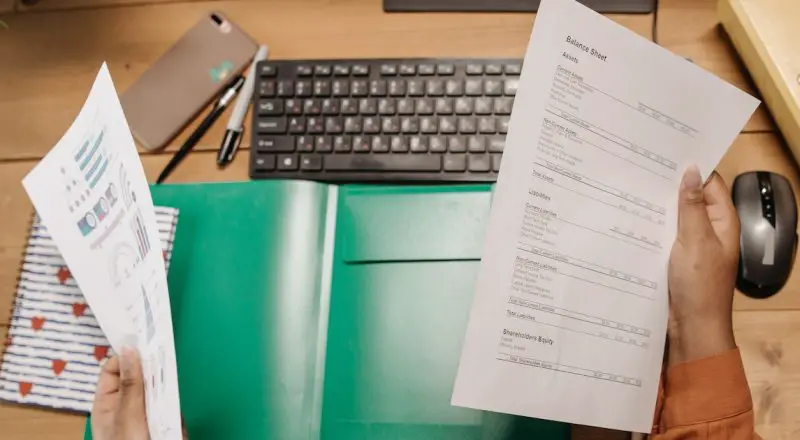

Balance Sheet

The main financial statement is the Balance Sheet. This is because it is through it that the company is able to show its current situation realistically and evaluate its assets.

The document consists of two columns, one for liabilities and one for assets. On one side, all the company's financial commitments are listed, that is, the amounts to be paid. On the other, everything that generates value is placed.

The difference between assets and liabilities is net worth . The Balance Sheet is mandatory and must be prepared at least once a year.

DLPA

The Statement of Accumulated Profits or Losses (DLPA) is a mandatory financial statement for some legal entities, such as limited companies. The document must include:

- the balance at the beginning of the period and adjustments from previous years;

- reservation reversals;

- net profit for the year;

- transfers to reserves;

- dividends;

- portion of profits incorporated into capital;

- balance at the end of the period.

DVA

The Added Value Statement (DVA) is a document that informs the wealth generated by the company in a specific period. Its objective is to facilitate the assessment of the company's role for social development and the economy in general.

Cash flow

Cash Flow is the record of all financial transactions that took place in the company in a given period. He must consider both internal cash inflows and outflows as well as financial investments and bank accounts.

Thus, management is able to know exactly where the resources were applied and what their main expenses were. In addition to better control, making this financial statement helps you make data-driven decisions.

DRE

The DRE, or Income Statement , is also one of the company's most important financial statements . It presents, in summary form, all the results obtained by the company in a given period.

As it must be carried out at least once a year, the most common thing is to analyze the last 12 months.However, it is also possible to have DREs for shorter periods, if managers want to have greater control over finances.

The DRE must have:

- gross sales revenue;

- sales deductions and rebates;

- taxes;

- net sales revenue;

- gross profit;

- cost of goods;

- financial and sales expenses;

- operating profit or loss;

- result of the year before Income Tax and the provision for it;

- net profit or loss for the year and its amount per share of share capital.

Explanatory Notes

Explanatory notes are documents that provide information to clarify the company's situation and can be related to any of the financial statements.

Typically, they are used to disclose information required by the government that is not found elsewhere in the documents. In addition, they provide additional information or indicate information about the basis for preparing the financial statements

How to Analyze Financial Statements?

The time has come to apply what you know about financial statements . To do this, we have separated three important tips to add to your documents.

Identify Trends

Financial statements not only reflect the past transactions of the company but also play a key role in providing insights into its future performance.

By analyzing these reports, it is possible to identify trends and patterns that can guide strategic decisions, such as investments, cost cuts and operational changes.

Taking advantage of this comprehensive perspective of statements allows for a more accurate and informed view of the company's financial health. Based on this data, you can make more assertive and informed decisions, anticipating future scenarios and adjusting your strategy accordingly.

Use More Than One Demo Type

When dealing with the financial management of your business, it is important not to skimp on using different types of financial statements . This way, you will have a comprehensive and more complete view of the economic situation.

This broad approach allows for proper compliance with tax obligations and also provides crucial information for making assertive decisions in the development of the company.

That's because combining a variety of statements helps identify trends, strengths and areas for improvement, allowing timely corrective action to be taken.

Cruse Information

Make comparisons between the information contained in the different financial statements . Also, cross-analyze with market data, political and economic scenario, and other relevant factors of the period under review.

This approach provides a comprehensive and in-depth context for better interpretation of data, allowing you to inform your actions.

By comparing information and contextualizing it with external information, such as market trends and economic indicators, you obtain a more complete and updated view of your company's situation.

This comprehensive analysis provides valuable insights to identify growth opportunities, potential risks and areas that require special attention.

Additionally, comparing financial statements helps detect inconsistencies or patterns that indicate errors or areas that require adjustment.

Are Statements Mandatory?

Financial statements have a mandatory part related to taxes. In this way, they serve as a basis for the company's fiscal analysis in relation to the generation of resources, payment of taxes and compliance with the chosen tax regime.

However, in addition, they are essential for effective business management and business success. After all, they provide transparency about the activity carried out, attracting investors, informing stakeholders and demonstrating credibility.

Not to mention that these documents also enable lines of credit and bank financing to invest in whatever is necessary for your growth.

Tips for Writing Financial Statements

So far you've learned a lot about financial statements , now is the time to prepare them using some tips to ensure maximum quality and effectiveness.

Use Accessible Language

In the financial and accounting world, there are specialized jargons that are not widely understood. When creating reports and statements, it is essential to use clear and accessible language, as not everyone involved in the company is familiar with financial terms.

In other words, simplify the information in your financial statements whenever possible to ensure that it is understood by readers.

Have a logical structure of information

When creating statements, it is essential to organize the information in a logical and clear way. Although there is no specific order, it is recommended to establish a coherent structure to present the results.

Furthermore, it is essential to properly separate information related to profits and losses. This way, any ambiguity or confusion in the interpretation of data by users is avoided.

Therefore, when compiling financial statements , make sure that you have an easy and accurate understanding of the information contained in the reports.

Focus on What Really Matters

Accounting statements contain a great deal of important information for accountants and financial professionals.

However, for those who are not experts in this area, the focus is on the key numbers that really impact the decisions of investors, managers and business owners.

When designing and compiling statements, it is critical to adopt a strategic approach and think like a manager. This means highlighting information essential for making decisions and developing effective action plans.

By presenting only relevant data, you provide a clear and concise view to stakeholders, increasing the accuracy and value of the information delivered.

Keep Data Up-to-Date

When preparing results for review by the company's management committee, it is crucial to be aware of the frequency of this review. Ensure that all relevant information is included in the submitted reviews.

It is extremely important to avoid presenting outdated data, as this can have a negative impact on both your work and the decisions made by the company. Therefore, it is essential to ensure the continuous updating of information.

Furthermore, all employees in the financial/accounting sector must be familiar with the reporting processes, the underlying logic and the data used.

This understanding allows everyone to contribute to the quality of the financial statements presented, promoting trust and accuracy in the information provided.

Author: admin

Date: Sep 17 2023

Find out what cash control is and how to adopt it

Cash control is a practice that should never cease to be part of a company's routine. And this, of course, regardless of its size or time in the market.

It is through this control that the manager will understand how much cash comes in and goes out, which facilitates good financial management. As you know, it is essential for the success of any business.

In this article, you will know everything about cash control. We will explain what it is, why it should be done and present a step-by-step guide to implementing this activity in the company's day-to-day operations.

Follow the article!

What Is Cash Control?

Cash control is the monitoring of all cash inflows and outflows from a company's accounts . Any and all financial transactions must be recorded by management, no matter how small.

Thus, it is possible to have, on a daily basis, a realistic view of how much money the company has available to meet its financial commitments. You also know how new investments are going and how to start generating profits for your investors.

What is Cash Control for?

Cash control must be done so that the manager knows where the money the company moves comes from and where it goes. Furthermore, it helps you understand how much is left in the accounts.

This way, it is possible to maintain financial control of the business, as it is essential for the maintenance of any company.

Cash control also allows the manager to quickly analyze the results obtained.

This way, it is possible to predict problems and anticipate their solutions, in addition to identifying fraud and making decisions more intelligently. And of course, all this always based on data.

Finally, good cash control also helps maintain working capital and gives the company greater negotiating capacity with its suppliers and customers.

How Does a Cash Control Work?

As we have seen, cash control is used to monitor all financial transactions that occur in a business.

The process for operating cash control begins with opening the cash register at the beginning of the period, where the opening balance is recorded.

As sales are made, the amount is added to the cash register. Likewise, when payments or withdrawals of money occur, these outflows are recorded.

At the end of the period, the cash register is closed, comparing the recorded balance with the existing physical cash. Any differences must be investigated to identify possible errors or discrepancies.

Efficient cash control can also include issuing receipts, organizing invoices and carrying out bank reconciliations to ensure the accuracy of records.

What is the importance of cash control?

Cash control is a relatively simple activity. However, it is of great importance for a company to remain financially healthy and, thus, continue to operate and generate profit.

This control must be rigorous and is essential for the company to be aware of its expenses and be able to predict its growth trends.

Only in this way can the manager have access to truly realistic data about the business situation and make better decisions. Furthermore, control allows you to make more efficient financial planning for future periods.

Control VS cash flow

Cash flow is the set of financial movements that occur in a company's accounts. Many people confuse this concept with cash control , but there are some differences between the two.

Cash flow considers all of the company's finances, such as balances in its accounts, payments made, debts and financial commitments. In other words, it encompasses all the resources that the company has.

Cash control is a more immediate task, focused on day-to-day life. Both controls are important and must be carried out in a thorough and detailed manner!

What is the purpose of a cash flow?

The main objective of a cash flow is to provide a clear and accurate view of a company's cash inflows and outflows over a given period. It helps monitor financial health, control expenses, predict liquidity problems and make strategic decisions.

By analyzing cash flow, managers can identify revenue and expense patterns. Furthermore, they can plan investments, adjust payment and receipt deadlines, and anticipate working capital needs.

Furthermore, an efficient cash flow helps in evaluating the company's financial performance, allowing comparisons with previous periods and establishing goals for the future.

How to Control Cash?

Now that we've talked about the importance of cash control for the company's financial health, let's get down to practice. Next, you can check out the step-by-step we prepared!

Categorize Your Expenses

The first step towards effective cash control is to know well all the company's expenses. So, to do this, analyze the cash flow and separate them into categories: expenses with suppliers, employees, consumption bills, etc.

This way, you can start your cash control with a broad view of the use of business resources. This makes it easier to understand where the money goes and the percentage applied to each category.

List Your Earnings

Then, do the same thing with your recipes. Here, you can separate them into categories such as cash payments, installments, and investment gains, among others.

This way, you will know where the company's resources come from and, comparing it with expenses, you will quickly understand whether the company is operating in the red or not.

Check the Opening Balance

When opening the cash register, you should always check the opening cash balance. And you must make sure that this value corresponds to the value recorded at the closing of the cash register for the previous period.

Check out the origin and destination of money

Remember to always record all inflows and outflows of money, identifying the origin and destination. For example, if the origin is like sales, loans or other sources, and the destination is like supplier payments, operating expenses, or salaries, among others.

Keep an eye on payments

Monitor bill payments, suppliers and other expenses. Be sure to record these cash outflows properly in cash control .

Make Throws Correctly

When recording transactions, be accurate and detailed. Include information such as the date, amount, transaction description, and type of income or expense. This helps to have a complete history and makes later analysis easier.

Set a Period

Cash control must be done periodically and it is important that you define the time interval in which this will happen.

Depending on the specifics of the company, this could be a daily, weekly or monthly task. In some cases, it is necessary to check cash even more than once a day.

The smaller this interval, the greater the control over cash!

It is best for this task to be carried out daily. This way, it is possible to carry out more rigorous control, predict problems and identify errors before they harm other sectors of the company!

Register the Amounts Receivable

In addition to listing everything that is coming in and out of the company's accounts, it is also important to record amounts receivable in the future. These launches help you negotiate with suppliers, have more predictability about earnings and plan smarter!

Make Constant Adjustments

Once you've created a cash control routine, don't think the work is over. This is because, in addition to daily monitoring, it is necessary to keep an eye on the need to improve these processes.

In this way, management can carry out increasingly better, more complete and more accurate control. This way, the path to your goals can be followed more clearly.

Author: admin

Date: Sep 17 2023

What is a Balance Sheet and How to Do It

Furthermore, it also serves as support so that every business can improve its decision-making and financial management.

So, in this post, we will explain in detail what it is, what its structure is, the calculations that are part of it, how to analyze it and more tips! Follow along and learn how to simplify this process in your business!

What is a Balance Sheet?

The balance sheet is an accounting document, like the DRE , that informs the situation of all of a company's assets. This includes your assets, rights and obligations, as well as investments and sources of funds.

With this report, it is possible to better understand the financial position of the business within a given period. To do this, all the company's records are investigated, that is, all the accounting facts that appear in the company's daily book.

What Is the Purpose of the Balance Sheet?

The purpose of the balance sheet is to provide a clear and accurate view of a company's financial position at a given point in time.

It helps to understand the composition of assets, liabilities and equity, allowing you to assess the liquidity, solvency and profitability of the business. Therefore, it is a fundamental tool for analysis and strategic decision-making.

What is a company's balance sheet for?

In addition to being an obligation provided for by the Civil Code for most companies, the balance sheet is extremely useful.

Even if your company is small, this survey helps you see your financial situation more clearly, accurately and transparently. This way, it is possible to guarantee better conditions to manage a business.

In summary, the balance sheet 's main function is to provide an accurate picture of the company's accounting and financial situation in a certain period. And this balance is generally done over a period of one year.

It is considered one of a company's main financial statements and must be produced accurately and rigorously. The idea is to enable efficient asset control.

From the report, it is possible to clearly view the inflows and outflows of money, in the following ways:

- Indicating the moment of the company;

- Identifying debt capacity, profitability, growth and investments;

- Facilitating decision making and creating accurate plans based on data.

In addition, it is also widely used to carry out strategic planning for companies.

How Important Is the Balance Sheet?

The balance sheet is a report of great importance for the management of a company.

Firstly, it is essential for it to carry out its activities in accordance with the legislation. But, in addition, it can also serve as a basis for an analysis of the company's financial health.

From this, it is possible to make smarter decisions about the business. After all, the document indicates whether the company is having a positive or negative result.

This is the starting point for a series of decisions that can be made, depending on the result.

The manager may decide, for example, that it is necessary to cut some costs to balance the accounts. It is also possible to point out when to make new investments, such as hiring new people, buying new machines, etc.

As we have seen, some companies must prepare the balance sheet annually. Others quarterly. But management does not need to stick to this periodicity.

This is because companies that wish to have greater control over their finances can prepare the document more frequently.

How Does the Balance Sheet Work?

The balance sheet has a simple structure, with just three main pieces of information: assets, liabilities and equity.

So, in practice, it has a table format, with two columns. On the left are assets, which are goods and rights. On the right, there are liabilities and obligations related to equity.

Due to this table structure, the analysis of the balance sheet is very objective, giving the manager a summary of the company's financial health. But even so, it provides information that can be valuable for decision making.

What are the advantages of using the balance sheet?

The main advantage of using the balance sheet is having a realistic view of the company's financial health without having to analyze large reports.

In other words, the balance sheet offers an overview of what is happening with the finances.

Thus, management can make decisions based on data , understanding the best time to hold back on spending or make new investments.

From the document, the manager can also choose some aspects of financial management to deepen their analysis. This is because he will know which points need greater control for the company to have a healthy financial life.

When to Make a Balance Sheet?

Due to its importance, the balance sheet is one of the main financial statements made by the company. Therefore, for greater efficiency, it is generally done every 12 months, at the end of the year.

Therefore, detailed control of information must be carried out. Ideally, when producing the balance sheet at the end of the year, all information is included in detail in the annual control.

What to Analyze in a Balance Sheet?

One of the advantages of the balance sheet is the possibility of carrying out different analyses. Just the way this report is put together generates a quick answer as to whether or not your company will be able to meet the commitments made.

In other words, it is possible to carry out various analyzes based on the balance sheet . One of the best is whether the amount of liabilities for the period could be detrimental to your company's financial growth.

What Is the Structure of a Balance Sheet?

Basically, the balance sheet reports the company's assets, liabilities, and net worth for a given period.

See more about each of them below:

Active

Assets on the balance sheet are everything your company has of value that can be converted into cash.

The accounting report will list assets in order of liquidity, meaning how easily they can be converted into cash. Within assets there are two categories:

- Current Assets: can be converted into cash within a short period of time. Examples include cash, accounts receivable , inventory, marketable securities, etc.

- Long Term Assets: These cannot be converted into cash in the long term. They include fixed assets (property, buildings, machinery and equipment), and intangible assets, which are not physical objects, such as franchise agreements and patents.

Liabilities

A company's Liabilities are the financial responsibilities it has, including recurring expenses , loan payments and other forms of debt.

Like assets, liabilities are also subdivided into two categories:

- Current Liabilities: rent, interest and payroll payments, taxes, etc.

- Non-Current Liabilities: long-term loans and deferred income taxes. It also includes all obligations that must be paid within a period of more than 12 months.

Net worth

Net Equity is the difference between total assets and total liabilities. It refers to the amount of money generated by a company; the amount of money put into the company by its owners (or shareholders).

The relationship of these items is expressed in the following equation:

Assets = Liabilities + Equity

The total value of the asset must be equal to the total value of the liability added to the net equity. But, if this doesn't happen, you need to go back and look for where the error is.

What Are the Types of Balance Sheets?

There are two main types of balance sheets : the vertical balance sheet and the horizontal balance sheet .

The vertical balance sheet presents the values of assets, liabilities, and equity as a percentage of total assets. This allows for an analysis of the company's financial structure and the identification of trends over time.

The horizontal balance sheet shows the values of assets, liabilities and equity in different periods of time, usually in adjacent columns. This allows for direct comparison and analysis of changes over time.

Both types of balance sheets are useful for assessing a company's financial health and providing valuable information for financial analysis and planning.

How to Create Your Company's Balance Sheet in 5 Steps?

Creating your own business's balance sheet is really not a very easy task. But, if you've made it this far, you already have the necessary information to be able to develop your accounting report.

See the main steps to prepare your balance sheet

1 – Determine a Period

As you already know, the balance sheet shows the company's financial situation within a specific period. So, the first step is to determine the reporting date.

In general, the balance sheet is always prepared every 12 months. Publicly traded companies, for example, do it every three months.

2 – Score Your Assets

With the date set, you need to consider and account for all your assets within that period.

To make analysis easier, consider listing assets as individual assets and total assets.

It is much more complex to understand the report when assets are divided into different line items.

Two groups divide the assets:

Current Assets:

- Cash and cash equivalents;

- Bills to receive;

- Short-term negotiable securities;

- Others.

Non-Current Assets:

- Long-term negotiable securities;

- Intangible assets;

- Property;

- Others.

Both current and non-current assets must be subtotaled and added together.

3 – Score Your Liabilities

Identify the company’s obligations to third parties. They are also divided into two groups, just like assets:

Current Liabilities:

- Rent;

- Interest payments;

- Accumulated expenses;

- Others.

Non-Current Liabilities:

- Long-term loans;

- Deferred income taxes;

- Long-term debts;

- Others.

Just like your company's assets, liabilities need to be subtotaled and then added together.

4 – Calculate Net Worth

In this step you need to list the accounts that indicate the book value of your company. To be simpler, consider, for example, share capital, accumulated profits, cash flow , among others.

Is the company private? If it is owned by a single owner, it will be simpler to calculate the net worth.

Now, if we are talking about a publicly traded company, this calculation may become more complicated. See some examples of net worth below:

- Share capital;

- Capital reserves;

- Profit reserves;

- Actions in Treasury;

- Others.

5 – Compare Total Liabilities and Equity with Assets

With the balance sheet equation , a balance is expected between assets and the amount of liabilities.

But, to do this, you need to prepare the report like this:

On the left side, we have the assets. On the right side, there are liabilities and equity.

Values are always grouped into accounts and their order is determined by the liquidity situation. This is because this way, it is easier to analyze the report.

How to Calculate Net Equity on the Balance Sheet?

To calculate net worth on the balance sheet , you need to subtract total liabilities from total assets.

By subtracting liabilities from total assets, you obtain the value of shareholders' equity, which represents the portion of the company's assets that belongs to shareholders or owners.

This value reflects the net value of assets after deducting all liabilities. In other words, it is the residual value that would be left to the owners if all assets were sold and all debts were paid.

How to Carry Out a Balance Sheet Analysis?

Balance sheet analysis involves evaluating the components of the balance sheet to understand the financial health and condition of the company. Here are some steps to perform the analysis:

- Evaluate the structure and composition of assets: Analyze different types of assets, such as cash, accounts receivable, inventories and investments. Check that the company has a solid asset base and that they are balanced.

- Analyze liabilities: Examine liabilities such as accounts payable, loans, and tax obligations. Check whether the company has a sustainable level of debt and whether it can meet its obligations.

- Calculate financial ratios: Use financial ratios, such as current liquidity, dry liquidity, debt and profitability. The idea is to obtain a more detailed view of the company's financial situation and its ability to generate profits.

- Compare with previous periods and the sector: Make comparisons with the company's previous balance sheets to identify trends and changes. Additionally, compare the numbers with those of the industry in which the company operates to assess its relative performance.

- Identify strengths and weaknesses: Based on the analysis, identify the company's strengths, such as good liquidity or profitability. Also, look for weaknesses, such as high debt levels or low operational efficiency.

- Make informed decisions: Use the insights gained from analysis to make informed decisions about investments, financing, growth strategies and improvements in the company's financial operations.

Remember that balance sheet analysis must be done in conjunction with other financial information and metrics. The idea is to obtain a comprehensive view of the company's financial health and performance.

Author: admin

Date: Sep 17 2023

8 tips to help secure your children’s future

Saving, investing and prevention are three essential concepts to pass on to your children. Find out how you can teach them and thus ensure they have a prosperous future.

If you have young children, you've probably already thought about how you can help them prepare financially for the future. In this field, there are many aspects that parents must consider to ensure their children's future and guide them on the right path.

Building a nest egg, ensuring stability in case of unforeseen events and instilling some basics of budget management are important steps towards their financial education. Discover eight tips to ensure a financially bright future for children.

1. Save money

Mutual savings is a way to save money for your children's future. This savings could have various purposes, from paying for university studies, helping to buy a house or facing the first years of working with low income. The Young Complementary Savings , for example, allows reinforcements at any time. You can stipulate an amount to transfer every month, to “fatten up” the account effortlessly and still benefit from the interest paid.

2. Take the opportunity to teach them how to save…

Savings account management is also an opportunity to teach them how to manage money and instill in them some savings basics. When they already have some understanding of mathematics, start involving them in the process. Together with the children, record each deposit they make on a sheet of paper and ask them to add them up and check the result. It is important for them to understand that, with small deposits, they will be able to save a good amount for the future.

3. …and teach how interest rates work

When the children have understood the concept of saving, you can take the opportunity to talk about the importance of interest in savings. Simply put, explain to your children that interest is a reward that the bank gives them for having the money saved in their coffers. If they are old enough to understand, you can show them the bank statement and how much they earn, for a certain period, in interest.

Once you have grasped this concept, you can move on to a more complex one: compound interest. Explain that the money the bank pays them will be added to the amount they already have in the bank and automatically invested in the following period, making the amount invested higher. Consequently, the money you will receive in the following period for interest will be greater.

4. Talk to children about money

Money should not be a taboo subject in the family. If you talk openly about the subject with your children, they will easily develop a healthy relationship with money. It is important to talk about the parents' income, where they spend their money and explain how they manage the family budget. By being transparent about these matters, it will be easier for children to value money and learn to use it wisely.

5. Assign an allowance or weekly allowance

Around the age of five or six, depending on the maturity of the children, you can allocate a weekly allowance to your children, according to ASFAC – Association of Specialized Credit Institutions. This is when you should start encouraging them to set small goals and save money to achieve them. Later, around the age of 10 or 11, you can switch to pocket money. Encourage them to create a budget to manage their allowance, define where they will spend the money (leisure or clothing, for example) and set aside a portion to save.

6. Involve them in the family budget

It is important that your children participate in some of the family's financial decisions, related to the family budget. For example, if you decide to take a trip to Europe, you can get the family together to create a vacation budget. By analyzing the family budget together, they can more easily discover where they can save. It's a way of teaching them that travel is not free and that, sometimes, you have to make sacrifices to achieve your goals.

7. Make an emergency fund

An emergency fund is a way of protecting the family's stability, in case an unforeseen event occurs that prevents parents from earning income for a certain period of time. Such as, for example, prolonged unemployment or an accident that forces them to stop working for some time. The emergency fund must have at least the equivalent of six months of fixed expenses. It must also be applied to a product that can be mobilized at any time. This way, at a time of greater financial difficulty, it will not be necessary to allocate money from savings for daily management.

8. Protect your children's future

Anyone who has children has at some point thought about what will happen to the family if one of the parents dies or becomes disabled. One way to ensure that your descendants' lifestyle is not compromised by a family loss is to take out life insurance that safeguards the children's future in the event of a serious illness, disability or death of one of the parents.

Author: admin

Date: Sep 17 2023

What are the main factors that make it difficult to determine costs in small and medium-sized industries?

As it is a non-serial process, the construction of a tool is more complicated to determine, in terms of costs .

This verification of tooling is very different, for example, from the manufacture of screws – which are serialized. In this manufacturing, due to its standardization, each step can be calculated much more easily. In the construction of a tool, this becomes complicated, as it is custom-made and, therefore, it is rare for there to be two or more identical ones.

It is possible to only have an estimate of the costs required to assemble a tool, which is made based on a sketch provided by the customer, which can be changed over the course of production .

Another complicating factor is the time it takes to convert the quote into orders. In other words, the initial budget is given to the client, but he and his company have internal processes, which can ensure that the budget is approved just a few months later. However, at this time the price of materials , or even the cost of energy needed to build the tooling, for example, may have been affected and increased.

Furthermore, there may be cases of so-called “dead parts”, in which the parts may be machined incorrectly, receive the wrong heat treatment, and, as a result, the block is lost and it is necessary to buy a new one, possibly from a new price, and start the whole process over again.

What are the main measures that can be implemented by the manager to resolve these pains?

In Brazil, there is great difficulty in defining a methodology for

budget systematization. Companies end up calculating budgets for the same part, with huge differences, which should not happen.

Christian reported in the interview that in one of the courses he taught, two groups of businesspeople were asked to calculate the costs of the same part, the same tooling, and that there was a difference of almost 600% between these calculations. In this activity, one of the groups came to the conclusion that 200 kg of tooling would cost 50 thousand , while the other concluded that 1150 kg would cost 300 thousand.

In other words, there needs to be a coherent calculation methodology, a standardization of the way to calculate these costs, based on mechanics, technique and data, to train and systematize companies in the construction of tooling budgets. The lack of this systematization also affects the conversion rate into sales .

How can software help the manager and the company's overall results?

Management software, such as ERP Industrial , facilitates the entire production process and calculation of tooling costs.

They help in fully visualizing all the processes and factors included in this production, unlike Excel spreadsheets or handmade calculation notes, as these lack reliable information , as they are much more susceptible to errors and duplication of data.

When using software, all sectors and stages of production and sales will be interconnected, automating the flow of information within the company, making it much easier to calculate tax variations, for example, and, consequently, calculate possible discounts. in products.

These management tools precisely optimize and boost the circulation of data, which directly impacts the company's results in a positive way.

Difference between turnover and profit

Revenue is the total revenue that enters the company, including the amounts discounted to cover operating expenses and the remaining revenue – profit .

Once the company's results generate profit, it can use this money to reinvest in the company, keeping it updated in the market, both in machinery, computers and maintenance of facilities and in employee training, for example, so that productivity is boosted in all company environments.

This is essential for it to stand out from the rest, maintaining its level and competition.

Difference between 6 essential concepts in finance

Spending

They are all types of money outflow from the company and are divided into: Costs, Expenses, Investments and Non-operational expenses.

This last type differs from the others, as it is not part of the company's business expenses, such as loan payments, for example.

Costs

They are directly linked to production, that is, any end activity that makes the product ready for sale.

It is divided into fixed cost and variable cost :

- Fixed: It is not affected by any variation in the business, that is, it remains the same, such as machinery, for example;

- Variable: Monitors business variations and may increase or decrease, such as raw materials.

Expenses

Everything that is not directly involved in the product. These are expenses linked to the administration and commercial sector of the company, such as accounting services , security, food, etc.

Investments

These are values used to generate returns for the company, that is, to bring more revenue, such as new automated machines, for example.

Earnings

They are the revenue obtained by the company through the sale of its products. In other words, the production that was converted into sales.

Losses

These may be products with errors or expired ones – which need to be discarded, as well as amounts spent to cover unforeseen failures or accidents.

What are the impacts of raw material shortages and price fluctuations on profitability?

According to Christian, on average, 20% of the cost of a tool comes from raw materials and accessories. If there is a large variation in the price of these components, great caution is needed when creating a quote for a client, because they will often not accept a new calculation on it.

If there is a large increase in the price of raw materials, the company must pass the price on to the customer, so that it does not end up at a loss. Therefore, for this conversation to occur in a friendly manner, the company must be honest with the customer from the beginning about the possibility of a new quote.

Author: admin

Date: Sep 17 2023

Balance sheet: what it is, what it is for and how to create one for your company

Balance sheet is a document that breaks down all of a company's financial assets and liabilities during a given period. This includes income, profit, debts, investments and obligations, for example.

Its objective is to illustrate, with clarity and security, what the financial reality of the institution is at that moment. Therefore, it is essential that it is done correctly, guaranteeing reliable results, which can serve as a basis for effective decision-making.

To help you with this task, we created this article where we explain the main concepts related to the topic and teach you how to put together a balance sheet in a simple way. So, keep reading:

What is a balance sheet for?

The balance sheet is one of the most important reports in effective financial management . The document serves as a guide that indicates all of the company's assets and debts, which makes it possible to broaden the vision of the reality of the business.

The balance sheet can be especially advantageous for leaders and investors, as it allows them to clearly understand whether a business is profitable or not, being considered one of the most accurate financial indicators. From this, it is possible to analyze the company's financial health and propose the necessary changes.

Additionally, it can be a credit guarantor. After all, the solution is a transparent portrait of the organization's finances, which can be used as proof that it has the funds to hire and cover the expense.

When to make a balance sheet?